What is money? At hind sight, it’s a piece of paper that can buy you anything from a cup of coffee to a house. But why is money “money”? In other words, why money has to be a unit of transaction? Why does it have a value? Seriously, what’s stopping us from printing shit ton of bills and using them? In order to understand that, we have to go back in time.

Money Vs Currency

Money is an intangible concept. Currency that is a physical (hmm… will come back to it) manifestation of money.1 When you negotiate with a company about the salary you would draw from your new job, or the money you want to buy a commodity for, you are essentially agreeing upon your value (through your service or otherwise) to the company or about the commodity you are buying.

Earlier, transactions used to happen through barter – a direct trade of services. Barter system had this disadvantage of labelling ground. There was no uniformity in the currencies. For example, I may consider the exchange of an iphone for an expensive watch is more than a fare trade but it might not be a good deal to someone else (the story of a guy trading 10K bitcoins for a couple of pizza is a good read2). So, it became increasingly difficult to reach an agreement and eventually, people moved on to using other currencies that carried more or less similar values to most of the people.

However, it wasn’t always practical to trade items with each other and arranging the items of trade used to be time consuming (imagine waiting for truck full of bricks in the middle of the road while the other party is out there gathering enough salt to trade in exchange). That led to the token based transaction systems (using pieces of metals, cards and then papers) where each token was recognized some some agreed upon value and almost all commodities could be represented in terms of these tokens.

The chinese in 770 B.C. started minting tokens to be used as currency. Later the Asian empire of Lydia, in 600 B.C., started using the first official currency. The chinese had moved to using paper notes by then.

Value of a currency

Currencies as token (notes, coins etc.) enabled countries to do international trade of resources. However, it led to currency wars between countries (on the value of each other’s currency). Higher value of foreign currency meant importing goods from them were expensive (meaning a higher value), whereas lower value meant exporting resources to them would earn them lesser value. Countries weren’t necessarily always on the same page when deciding on the value of each other’s currencies. As a counter measure, the gold standard was devised.

The idea was to peg the value of a currency to the gold reserve (metal that’s scarce so that it can’t be minted/mined at will. Gold happened to be the most traded valuable metal) of it’s treasury. The scarcity of gold would control the currency in circulation. As long as the supply of gold doesn’t increase abruptly, gold reserves remain limited (meaning there is only so much gold in circulation) and the value of currency would remain fairly stable. However, eventually governments drifted away from this approach. Economists cite issues like:

- Deflation: Since there is an ever growing need for consumer goods in the market, the demand of commodities keep increasing, and as a result, the supply needs to increase. But since the circulation of money is limited in the economy, the prices of commodities needed to be reduced causing a deflation, which was not a great news for businesses. Some economists consider it an unfair bias against commodity producers.

- Instability: Sometimes, inflation is good. By introducing more currencies (minting/printing more money) in the circulation, the government can address major crisis like a recession (or a war). In gold standards, the government’s hand are tied in controlling the circulation of currency, and as a result, it’s cannot control an economic shock.

- Hoarding: As gold stocks are limited (due to scarcity) and it’s value going up over time, it might afford more things than what it can afford today. This leads to a common tendency for people to hoard as much gold as much gold as they can. If everyone thinks in this manner, the treasury would soon run out of it’s gold reserve and would have even lesser control on the economy.

Fast forward to today, what decides how valuable a currency (fiat currency)? Broadly categorizing factors are:

- Fixed rate: Here a currency’s value is pegged to another foreign currency (USD for example). Imagine we have a currency that is pegged to the US dollar where today 1 unit of USD = 10 units of OurCurrency. If the value of a dollar goes up, that means an equal increase in the value of our currency ( and a devaluation of USD means our currency’s value reduces). On the other hand, if it was not pegged to the USD, it would have remained unchanged, and with the amount of currencies we have, we would be able to afford lesser than what we could have afford a day before in the United states. In contrast, a devaluation of USD would enable us to afford more than we could afford yesterday with the same amount of currencies.3

- Floating rate: The demand (in comparison to supply) of a currency in the global currency markets. The more the demand in comparison to supply, the higher the value of currency. For a c

- Foreign exchange reserves: the amount of currency held by foreign governments. The more they hold, the lower the supply and the more the value. If the foreign treasury liquidates (sells) it’s reserve of a particular currency, the currency value would crash.4

This is why countries can’t keep minting money at will (without crashing the economy due to hyperinflation, Zimbabwe being a recent victim5). Or a country cannot liquidate it’s reserve of a foreign currency (without risking it’s own currency value) because it’s not the only country holding that particular currency. There are other countries who hold that currency in their treasury and all those combined determines the value of a currency.

Digital payment

Digital currency is equal in value to an physical currency of the same value. What that means is the salary that is credited to our bank account digitally can be withdrawn by us for an equal amount of physical currency. In the last century, we have become more used to cashless transactions. A lot of economies have embraced digital payments with open arms. Fintech is a common term in the tech industry these days. With the advent of internet, the 21st century is has seen major tech disruptions. Ordering your meal online is a matter of a few taps on the smart phone and booking a ticket from New York to Berlin has been easier than ever. That called for a need to carry out economic transactions online. Paypal and other similar services have been at the helm of digital payment. Online transactions happen through text messages or scanning QR codes on your phone.

Digital payment have made cash unessential, and to some extent a liability. How many of us remember those days you had to be really careful (and maybe watch your back from time to time) when withdrawing sizable amount of money (currency) from the bank while returning home with the constant fear of getting mugged or robbed. Not anymore! Transferring money to a friend or family member is just a matter of a few API calls and exchanging digital tokens. Money may stay in your bank or in your digital wallets (google, apple, amazon everyone have a wallet of their own with seamless integration with major banks).

However, digital wallets are not without it’s own problems. For example, what happens if your phone runs out of juice, Or there is a network disruption. Digital payment frauds are at an all time high. A lot of protocols and regulations have been put forward in the last decade, but their effectiveness has been constantly been challenged by hackers and hoarders. Even though digital currencies are all accounted for and leave a trail (good for the government because it takes more effort now to evade tax), that trail may still be erased. Lost money cannot be traced back easily either.

Centralized control

The banks are largely controlled and regulated by the government. Fiat currency is regulated by the banks. In other words, it would have no value if the government or the bank decides to declare them useless from tomorrow (If you think that’s not going to happen, here’s some inspiration). Your online transactions still flow through the bank (controlled by the state). In some way, they are still in control of all your money. In case of a financial crisis or a recession, the government may employ fiscal policies like an expansionary monetary policy to increase the money supply, increase the quantity of loans, reduce interest rates leading to an inflation.5 This leads to a decline in our buying capacity. At this point, it starts to feel like the government and the banks have too much power on the money that we so dearly claim as our own.

That paranoid guy in the movies acting all suspicious of the conspiracy theories and the state’s involvement, who doesn’t approve the idea of keeping money in the bank isn’t all too paranoid after all. You can also be sure that in case of a conflict of interest between the government and the people, policies would be made keeping the government’s best interest in focus.

Inflation

The cost of commodities and services rise year on year leading to inflation. On an average, the world economy inflates by around 2%6, thereby, reducing purchasing power each passing year. But what causes a global inflation?

- An increase in cost of essential raw materials like oil, minerals and natural resource prices may send out a ripple effect and increase cost of commodities.

- A surge in demand of products and services. Oil prices generally increase due to increasing demand and reducing supply.

- Fiscal policies by government

Keeping all the above in mind, money sitting in the bank account doesn’t sound like a very good idea. Every year, it will depreciate in value. Investing in assets that appreciate over time may be one strategy.

Virtual currency

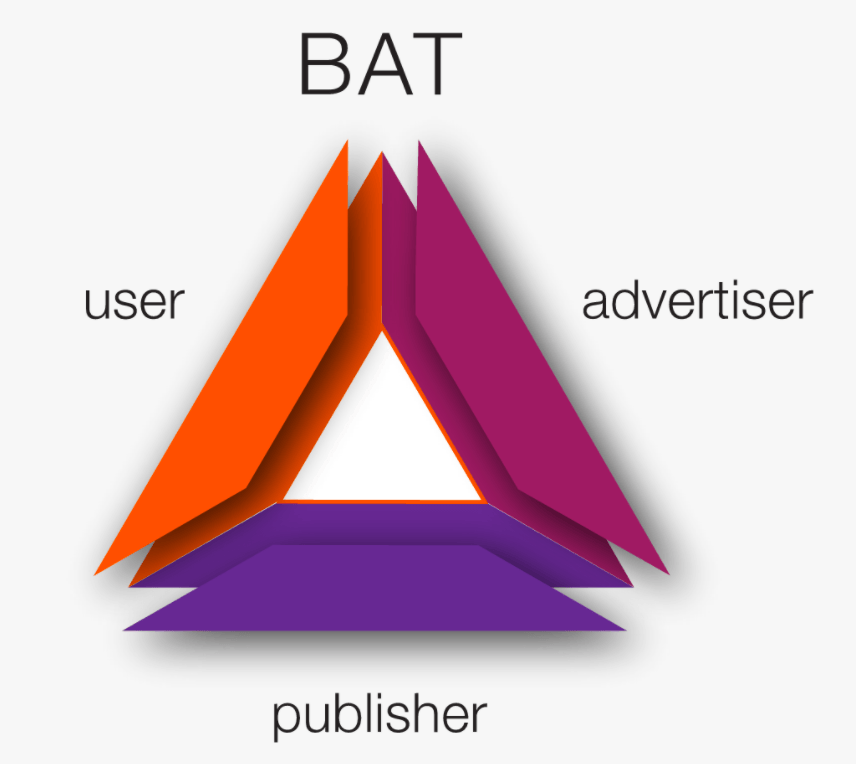

In 2009, someone using the pseudonym Satoshi Nakamoto published a white paper on peer-to-peer electronic cash transfer7 using block chain technology and named it Bitcoin. Today, Bitcoin has been the poster child of cryptocurrency. To a lot of people, they are one and the same. However, bitcoin is one of the many existing

(albeit the first and the most popular) cryptocurrencies out there in the market. Cryptocurrency uses blockchain technology, which is a decentralized computation technology. It is a virtual currency, meaning there is no physical coinage. Virtual currencies may be used as an alternative to government issued currency and without the involvement of any central authority. Unlike banks (that are centralized institutions controlling fiat currencies), virtual currencies are decentralized and are not managed by one central institution. As a result, service fees are minimal and are not impacted by the price of essential raw materials, keeping economic stability.

How bitcoin works

There are numerous computers running the bitcoin code comprising a network (distributed all over the internet). These computers are called nodes or miners (anyone can choose to be a miner). Each node has access to a public ledger. The public ledger tracks all the transactions (since the first transaction) in a transparent manner. When there is a new transaction, these nodes validate the legitimacy of the transaction. When the list of validated transactions reach a certain size (1MB for bitcoins), they make a “block”. The block is eligible to be appended to the blockchain. But in order to be added to the blockchain, it needs a unique token value (a hash) to be generated using all the transaction details in the block and the address of the previous block (linking this new block to the chain). But coming up with that hash is not a trivial task. Miners need to solve a puzzle to come up with the hash. The first miner (keep in mind that a miner might be a group of computers working together leveraging each other’s compute power) to come up with a hash value (discretionary to the system or network) is rewarded with newly minted currencies and the block is added to the blockchain with the hash value. This process introduces new currencies to the circulation (analogous to government minting notes).

The puzzle solving part is called Proof of work8 and is mostly a matter of guessing by generating random hashes that is smaller than or equal to a target hash value defined by the system. The faster and more number of hashes a miner can generate, the better his chances are. Once a miner comes up with a hash that meets the criteria, it is broadcast to the network and all miner nodes validate and vote (in case of a tie to determine the winner) if the value is acceptable (by fitting in the proposed value and based on the values they see in their copy of the ledger). The proof of work is important because this keeps fraudulent transactions from happening. Any tampering with a transaction would result in a different hash value than expected, and would be rejected. In order to perform a scam, the fraudster has to own (or hack into) 51% of the miner nodes. With each passing day, as new miners join the network, it becomes increasingly difficult to do that. This makes the system very secured. Also, the ledger data being public, transparent and immutable in nature makes it possible to track illegal bitcoin transactions.

In order to keep the production of blocks at a stable rate (and not introduce currencies at an arbitrary rate causing devaluation), the complexity or difficulty of generating the hash value for a block increases with the creation of every new block. There are only 21 Million bitcoins to be mined in the bitcoin network and so far (at the time of writing this blog) over 18.65 Million bitcoins have been mined. With every 210,000 blocks being generated (which takes around 4 years on an average), the number of bitcoins rewarded to the miners also halves. According to projections (the way it has been designed), the last bitcoin would be mined in the year 2140. After which, there would be no new bitcoin mining. However, miners could still earn bitcoins as processing fees from the transactions they validate.

Bitcoin value

Even though Bitcoin is not a legal tender (it is not recognized as a valid currency for transaction) by most governments, it has gained a lot of traction over the last couple of years. When bitcoin came into existence in 2009, it had no value. But today, bitcoin value has been at an all time high peaking at more than 50K USD. In 2009, mining bitcoins were easy and miners were awarded 50 BTCs. That value has touch 6.25 now. It will be halved even further to 3.125 in the future. However, the rising value of bitcoin brings a lot of incentives for the miners even today. One successful mining and you earn (6.25 * 50,000 USD) around 312,500 USD.

With each passing day the world is becoming more accepting towards the concept of cryptocurrency, to an extent that some governments are being forced to consider it as a legal medium of transaction. And it may happen sooner than we think. However, which government pioneers and makes a mark on the crypto landscape remains to be speculated. Till then, keep your wallets safe!